The Practice of the Future Just Arrived

I have been connected to the accounting profession for many years as a sole practitioner, consultant and public speaker. I have also lived through a number of recessions and every financial crisis seems to leave a permanent mark on the profession. COVID-19 is certainly no exception.

The 'practice of the future' arrived in a hurry around March 2020. Almost overnight, a high percentage of staff were working remotely and face to face client meetings were replaced by ‘virtual’ meetings on zoom. Some of these temporary measures may well become the new norm which means the need for traditional office space with a large reception area, meeting rooms, offices and work stations is now under review.

It’s been a whirlwind of change in a pressure cooker environment and it’s not over yet, far from it. One thing we know, accounting firms are going to look very different in the next few years and we just got a clear snapshot of what they might look like.

Promote Remote

The question of staff working remotely has been a dilemma for some time in the profession. For firms who have been sitting on the fence weighing up the pro’s and con’s, the decision was made for them at the end of March 2020 when the government imposed lockdowns. For firms who had been moving in that direction for the past few years, the transition was almost seamless. Either way, this is a game changer for the profession.

As

you know, it’s a tough industry and work-life balance remains a major challenge. On the plus side, working from home eliminates the commute

time that potentially frees up an hour or two every day that could translate into more sleep, exercise or recreational time. That could

lead to improved productivity, mental health and firm loyalty.

As

you know, it’s a tough industry and work-life balance remains a major challenge. On the plus side, working from home eliminates the commute

time that potentially frees up an hour or two every day that could translate into more sleep, exercise or recreational time. That could

lead to improved productivity, mental health and firm loyalty.

On face value, it’s a win-win situation, however, there was always going to be teething problems given some staff moved from their state of the art office (furnished with 3 monitors and a top of the range printer/scanner) to a home office working on a kitchen table with a laptop and a domestic all-in-one printer/scanner. Everyone’s situation is different and during the lockdown some staff had children in the house so the impact on productivity may not be known for some time. As people get used to the environment, you would expect better results.

The success of the remote working ‘experiment’ could be the start of another industrial revolution. Finding and retaining good staff remains a major challenge in the profession so offering a flexible work environment could provide firms with a recruiting edge. Having said that, how will you interview, recruit and induct new staff in this environment? The consensus seems to be, some staff will split their time between home and the office. Firms might down size their offices which will have a positive impact on commercial rents and overheads, however, it will require more investment in IT and cyber-security with staff working from home. Hot-desking could be a thing of the past. Working remotely was a perk in 2019 but in 2020 it could be the new ‘normal’.

The pandemic has impacted every industry and some have had big wins like manufacturers of cleaning products, IT suppliers and streaming services. Others have been big losers like airlines, travel agents, hotels and gyms. What about the accounting profession?

Back in March I forecast that COVID-19 presented accountants with a once in a decade marketing opportunity. The proactive firms got on the front foot and developed a client ‘survival game plan’ and shared it with their clients by email together with a stream of newsletters and JobKeeper update bulletins. It cut a lot of client mayday calls off at the pass and their fees will increase this year. They will also get plenty of referrals from appreciative clients.

On the other hand, the reactive firms sat back and got buried in distress calls and emails from their clients. These firms didn’t give their clients a road map through the crisis so their ‘energy vampire’ clients kept calling for help. These clients probably wanted the advice for next to nothing and it has taken its toll on practitioners. It has left many accountants physically and mentally drained plus they have very little to show for their massive efforts.

Growing, Slowing or Going?

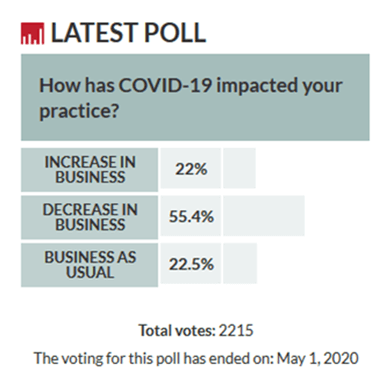

Incredibly, I saw this poll from Accountants Daily that suggested 55.4% of Australian firms have had a decrease in business as a result of

COVID-19. It makes no sense given accountants been on the frontline and in the trenches with their clients, working long hours and late

nights. I’ve heard a lot of accountants say they couldn’t charge clients the full amount because they were just helping them survive. In my

opinion, write offs are reserved for inefficiencies not advice that could make or break a business.

Incredibly, I saw this poll from Accountants Daily that suggested 55.4% of Australian firms have had a decrease in business as a result of

COVID-19. It makes no sense given accountants been on the frontline and in the trenches with their clients, working long hours and late

nights. I’ve heard a lot of accountants say they couldn’t charge clients the full amount because they were just helping them survive. In my

opinion, write offs are reserved for inefficiencies not advice that could make or break a business.

The Government response to COVID-19 has been outstanding, however, I think they underestimated the role accountants would play. Thinking back to the introduction of GST in 2000, every business received a $200 voucher that was redeemable for software or GST advice. Fast forward 20 years and the Government should have issued businesses with a voucher that was redeemable for help to explain and administer the government’s stimulus packages.

Let’s be honest, JobKeeper is the Accountant’s version of ‘War & Peace’ and accountants shouldered a big part of the administrative burden. Unfortunately, not every firm will emerge as a winner as a number of accountants made the decision to discount their fees to help their distressed clients with some firms even doing the work pro bono.

When you sell your practice you are selling your ‘future maintainable fees’. Helping clients produce cash flow forecasts and applying for JobKeeper and the other grants will not produce recurring fees. As such, this spike in fees might help your bottom line but they won’t increase the value of your practice. On a positive note, accountants who have run ‘compliance sweatshops’ for years managed to jump back into advisory roles to decipher JobKeeper and the stimulus packages. They repositioned their firms and their big challenge is, do they continue on this advisory path or do they slide back into the comfort of compliance? We all know what route is more fun and profitable.

Impact on Buyers and Vendors

- Will your future maintainable fees drop?

- Will you lose clients?

- What is the impact on the value of your firm?

These are three big questions and you probably won’t know the extent of the client losses until after JobKeeper finishes and the six-month moratorium on tenancy evictions ends. One thing is for sure, re-opening the doors of a business won’t guarantee survival. It will take time to rebuild the economy and consumer confidence. The economy effectively came down 35 floors in a lift out of control and it will need to be rebuilt via the staircase, step by step. The economists say it could take years and it certainly won’t be business as usual when all the restrictions are lifted. You may not know the full extent of your client losses until 2021/22.

The market has been starved of practices for sale for a number of years. In fact, we have more than 200 registered buyers and only a handful of vendors. What impact will COVID-19 have on the market? With most practitioners burning the midnight oil for the past few months to help their clients you would expect some burn out. With burn out, comes sell out, so we might see some more listings next year. However, the baby boomer generation are resilient and there are other factors at play. The pandemic took a big bite out of the stock market and a lot of ageing practitioners have had their superannuation slashed. They might work on and try and extract more profit from their practice to fill the financial hole. The issue for them is their ageing client base and deferring the sale might impact on the value of their fees.

Buyers are nervous and some firms will lose fees as the poll above suggests. Firms that specialise in industries like restaurants, travel agents and hotels are particularly a concern. May and June are typically the busy season for practice sales but the buyers have understandably retreated for the moment.

-P-J-Camm-banner.jpg)

Leave a Comment